Top 10 AI x DeFi Protocols in 2025: Exploring the New Wave of Intelligent Finance

Top 10 AI x DeFi : The year 2025 marks a turning point where Artificial Intelligence (AI) and Decentralized Finance (DeFi) are merging into a powerful new movement: AI x DeFi. This intersection is unlocking automation, smarter risk management, and adaptive trading strategies that were once limited to professional investors.

While still in its early days, this sector — sometimes called DeFAI — is already showing signs of major growth. Communities are experimenting with autonomous agents, developers are embedding AI into protocols, and investors are eyeing the potential of intelligent financial ecosystems. To understand this landscape better, here’s a closer look at the top 10 AI x DeFi protocols in 2025 that are pushing boundaries and shaping the future.

Why AI x DeFi is Rising in 2025 – Top 10 AI x DeFi

AI brings speed and adaptability, while DeFi provides openness and transparency. Together, they address some of crypto’s biggest challenges: inefficient strategies, manual oversight, and limited accessibility. Automated agents can now rebalance portfolios, identify arbitrage opportunities, and execute liquidation processes with minimal human input.

Personalized finance is also becoming a reality. By learning user preferences and risk tolerance, AI tools can recommend tailored strategies. Meanwhile, natural language assistants are making it easier for newcomers to navigate DeFi without needing advanced technical knowledge.

Still, this progress comes with hurdles. AI reliability, regulatory ambiguity, and the volatility of new tokens create risks. Yet the overall momentum suggests that intelligent finance is becoming a core theme of the next cycle.

ChainGPT (CGPT) — Building the AI Infrastructure for Web3

Source: IQwiki

ChainGPT is more than a single product — it’s an ecosystem. From AI-driven smart contract generation to NFT utilities and conversational tools, ChainGPT is positioning itself as an infrastructure layer for AI in Web3. Its most ambitious feature, the AI Virtual Machine (AIVM), allows AI agents to operate natively on-chain.

The CGPT token is the key to unlocking access to tools, staking rewards, and launchpad opportunities. With a vibrant developer community and strong adoption, ChainGPT stands out as a backbone for AI-powered blockchain services.

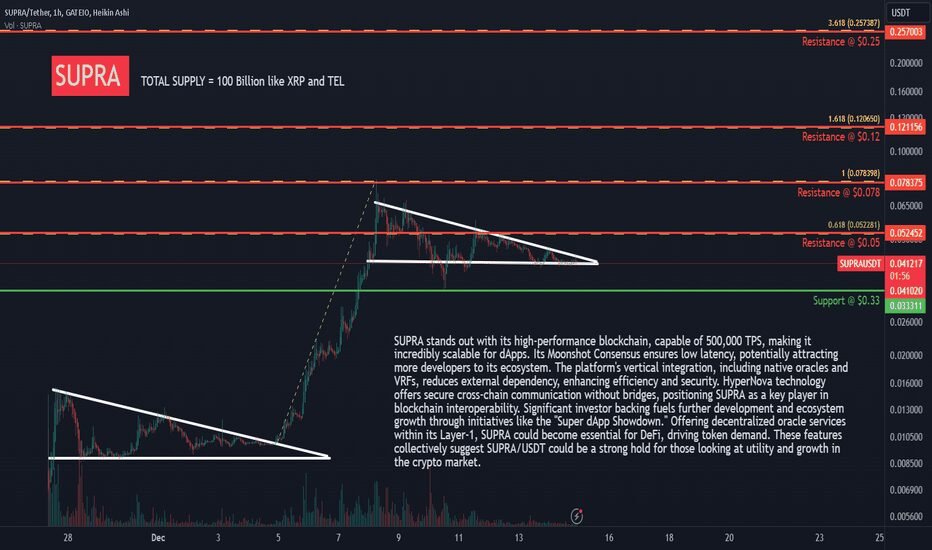

Supra (SUPRA) — An AutoFi Blockchain with Native Automation

Source: TV

Supra’s vision is straightforward yet bold: integrate automation into the blockchain itself. Dubbed an AutoFi Layer-1, Supra embeds features like native oracles, MEV protection, and cross-chain messaging. Its upcoming Supra 2.0 upgrade adds enshrined auto-arbitrage and liquidation processes, making automation a fundamental part of its core design.

Backed by Coinbase Ventures and Animoca Brands, Supra is emerging as a purpose-built chain for AI-enhanced decentralized finance.

Newton Protocol (NEWT) — Securing Trust in AI Agents

Automation is only as strong as the trust it inspires. Newton Protocol focuses on trust-minimized AI agents, combining Trusted Execution Environments (TEEs) with zero-knowledge proofs. This gives users verifiable assurance that AI agents act securely and as intended.

Adoption has been swift, with more than 280,000 agents active and a growing user base. The NEWT token supports compute costs, staking, and governance, ensuring community participation in protocol development.

Solidus Ai Tech (AITECH) — Compute Power Meets DeFi

Source: GateLearn

Solidus Ai Tech brings computing infrastructure into the DeFi world. Its high-performance data center and GPU marketplace allow users to rent computing resources while integrating with DeFi incentive models. A key feature is Agent Forge, a no-code builder that lowers barriers for deploying AI-powered agents.

The AITECH token powers governance, transactions, and its AI/Web3 project launchpad, with a deflationary burn mechanism in place.

Hey Anon (ANON) — Making DeFi Conversational

Source: CoinLore

Hey Anon is a conversational AI built for DeFi users. It enables natural language commands such as “Find me the best yield on ETH staking” or “Bridge my USDT to Arbitrum.” Beyond execution, it aggregates data from social platforms and market feeds, helping users stay informed.

With support from DWF Labs, Hey Anon is positioning itself as a personal assistant for navigating the increasingly complex DeFi ecosystem.

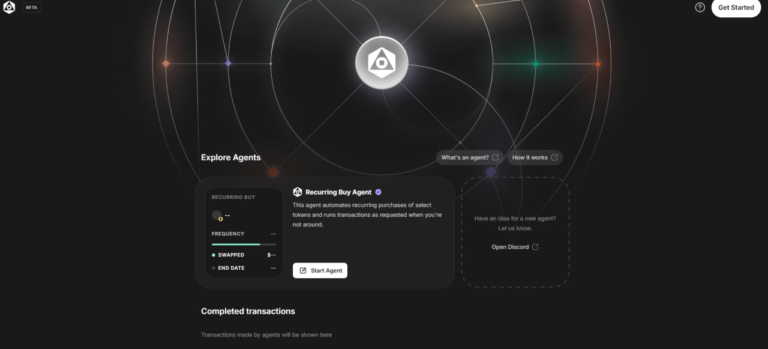

GRIFFAIN (GRIFFAIN) — Solana’s AI DeFi Engine

Source: griffain

Running on Solana, GRIFFAIN blends speed with intelligence. Its Agent Engine powers automated trading, NFT interactions, and memecoin strategies. The platform also features the @ Store, a marketplace for deploying pre-built DeFi agents.

Momentum is growing quickly, accelerated by its Binance futures listing. The GRIFFAIN token fuels transactions, governance, and incentive mechanisms within the platform.

Hive AI (BUZZ) — Turning Intentions into Automated Strategies

Hive AI simplifies DeFi by letting users express goals in plain language. Its Orchestrator Agent translates intentions into step-by-step strategies, while specialized agents manage lending, trading, and analysis tasks.

As a winner of the Solana AI Hackathon, Hive AI is gaining visibility and adoption. The BUZZ token drives governance and incentivizes network participation.

Fetch.ai (FET) — The Multi-Agent AI Economy

Fetch.ai is one of the most established players in AI x crypto. It runs a decentralized agent network capable of autonomous trading, data exchange, and DeFi integration. Its model is designed for real-world scalability, making it one of the broader ecosystems connecting AI with blockchain.

The FET token powers agent operations and marketplace activity. With strong cross-industry partnerships, Fetch.ai is well positioned as a bridge between Web3 finance and AI-driven automation.

SingularityDAO (SDAO) — Hedge-Fund Grade DeFi

Source: GateLearn

Spin out from the SingularityNET ecosystem, SingularityDAO is tackling portfolio management. Its DynaSets use AI-driven models to rebalance assets dynamically, seeking higher risk-adjusted returns. By blending machine learning with decentralized finance, it offers hedge-fund-style strategies to retail users.

The SDAO token governs the platform and incentivizes participation. This makes it an attractive option for users looking to combine professional investment strategies with the accessibility of DeFi.

Numerai (NMR) — Data Science Meets Decentralized Finance

Source: CoinBureau

Numerai has long been known as a hedge fund built on crowdsourced AI models. Through its Erasure protocol, it decentralizes predictions and financial data, rewarding contributors whose models improve accuracy.

The NMR token incentivizes quality while penalizing poor contributions. With new integrations into DeFi, Numerai is extending its expertise in AI-powered financial modeling into the decentralized arena.

Comparative View of the Top 10 AI x DeFi

These projects fall into distinct categories:

- Infrastructure Builders: ChainGPT, Solidus Ai Tech

- Automated Chains: Supra, Newton Protocol

- User Assistants: Hey Anon, GRIFFAIN, Hive AI

- Asset Management Leaders: SingularityDAO, Numerai

- Agent Networks: Fetch.ai

While their focus differs, all are united by one theme: embedding intelligence into financial processes. From conversational assistants to hedge-fund strategies, the scope of AI x DeFi is expanding rapidly.

Risks and Uncertainties – Top 10 AI x DeFi

Despite the progress, risks remain clear. AI agents can malfunction, smart contracts may be exploited, and regulatory bodies are only starting to respond to AI-driven finance. Scalability is another pressing issue, as agent-heavy systems could strain existing networks.

Volatility in token values also adds unpredictability, making research and risk assessment critical for users.

The Road Ahead: Top 10 AI x DeFi – Beyond 2025

Looking forward, AI x DeFi could evolve into a trillion-dollar sector. Future developments may include AI-governed DAOs, personalized robo-advisors for everyday users, and institutional-grade AI systems for risk and liquidity management. Data marketplaces may merge with DeFi liquidity pools, creating new financial primitives.

If adoption scales, AI will not just enhance DeFi — it will redefine it.

Conclusion – Top 10 AI x DeFi

The top 10 AI x DeFi protocols in 2025 highlight the energy and experimentation shaping the sector. From infrastructure like ChainGPT and Supra to user-facing platforms like Hey Anon and Hive AI, these projects are laying the foundation for decentralized, intelligent finance.

As this field grows, it offers both high potential and significant risks. What’s certain is that AI x DeFi is no passing trend — it’s a major shift in how finance will be built, accessed, and experienced in the years ahead.